TNREGINET Stamp Duty Registration

When you are buying or selling property in Tamil Nadu, one of the first things you need to consider is stamp duty. This is a mandatory tax that must be paid on property related documents like sale deeds, lease deeds, mortgage deeds, and gift deeds. Thankfully, the Tamil Nadu government has made the process of paying stamp duty and registering property documents much easier through the online platform, TNREGINET (Tamil Nadu Registration and Stamps Government Portal).

What is Stamp Duty?

Stamp duty is a government imposed tax that is required to be paid on legal documents. In the case of property transactions, stamp duty is applied to documents such as sale deeds, lease agreements, mortgage deeds, and gift deeds to make them legally binding. In Tamil Nadu, you can not legally register property documents unless the stamp duty is paid. If the stamp duty is not paid, the document would not be recognized by the law, which can cause serious issues down the line.

TNREGINET Stamp Duty Registration Fees

You have pay for the tnreginet stamp duty registration, as for-

• Legal Validity: The stamp duty payment ensures that the documents involved in property transactions are legally valid and recognized.

• Government Revenue: Stamp duty is a significant source of revenue for the Tamil Nadu government.

• Proof of Transaction: The payment acts as proof of the transaction and is essential in case of disputes or legal issues.

Simply put, stamp duty protects both buyers and sellers by making sure that all transactions are properly documented and legally enforceable.

How to Calculate Stamp Duty on TNREGINET?

In Tamil Nadu, the stamp duty is calculated based on the higher of two values. The market value of the property or the transaction value, whichever is greater than the percentage applied to this value determines the stamp duty.

Stamp Duty Rates in Tamil Nadu

Here are the general stamp duty rates that apply to different types of property transactions in Tamil Nadu:

1. Sale Deed:

#Residential Property: 7% of the market value.

#Commercial Property: 7% of the market value.

2. Gift Deed:

#For Relatives: 1% of the market value.

#For Non-Relatives: 6% of the market value.

3. Lease Deed:

#For leases lasting 1 year or more:Rs. 20 per Rs. 1,000 of the lease value.

4. Mortgage Deed:

# For Mortgages: Stamp duty typically ranges from 0.1% to 0.2% of the loan amount, depending on the property’s value.

These rates may change from time to time, so it is important to check the latest rates on the TNREGINET portal before proceeding with your transaction.

How to Pay Stamp Duty by tnreginet.gov.in

Now the Tamil Nadu residents can pay their stamp duty by TNREGINET. You can follow the given method to pay your stamp duty.

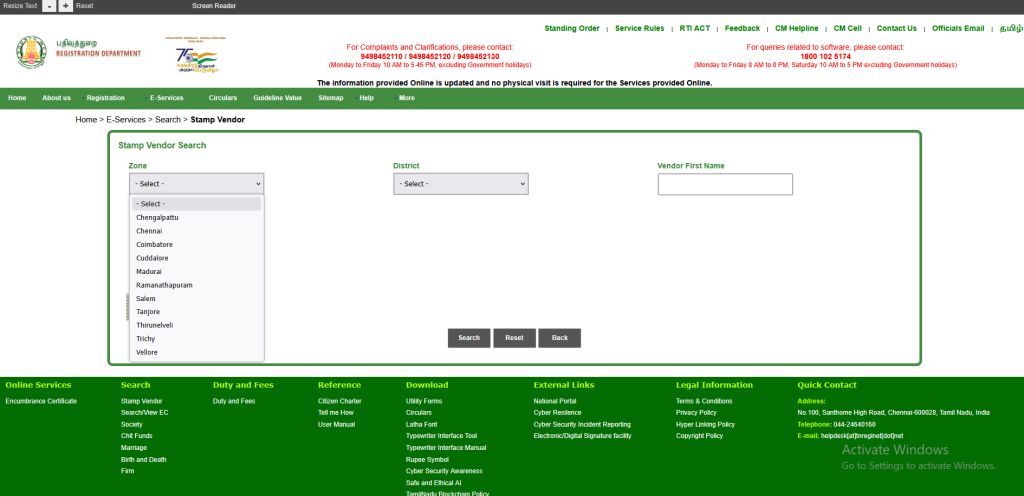

1. First visit the Official TNREGINET Portal at https://tnreginet.gov.in.

2. Next Create an Account or Log In. If you are using the portal for the first time, create an account by filling in your details. If you are a returning user, simply log in with your credentials.

3. Then select the type of property document you want to register whether it is a sale deed, lease deed, mortgage deed, or gift deed.

4. Next you will have to provide the property details, such as its location, market value, and the parties involved in the transaction (buyer, seller, etc.).

5. Stamp Duty Calculation based on the details you enter, TNREGINET will automatically calculate the stamp duty for you.

6. Next, after confirming the calculated amount, you can proceed with the payment. TNREGINET supports various online payment methods, including credit cards, debit cards, UPI, and net banking.

7. When your payment is made, you will get a receipt. Make sure to save this receipt as proof of your stamp duty payment.

8. After paying the stamp duty, you can either complete the document registration online or visit the sub registrar office if necessary.